Don't have an account?

Login to EaseMyDeal

2023-12-14

146

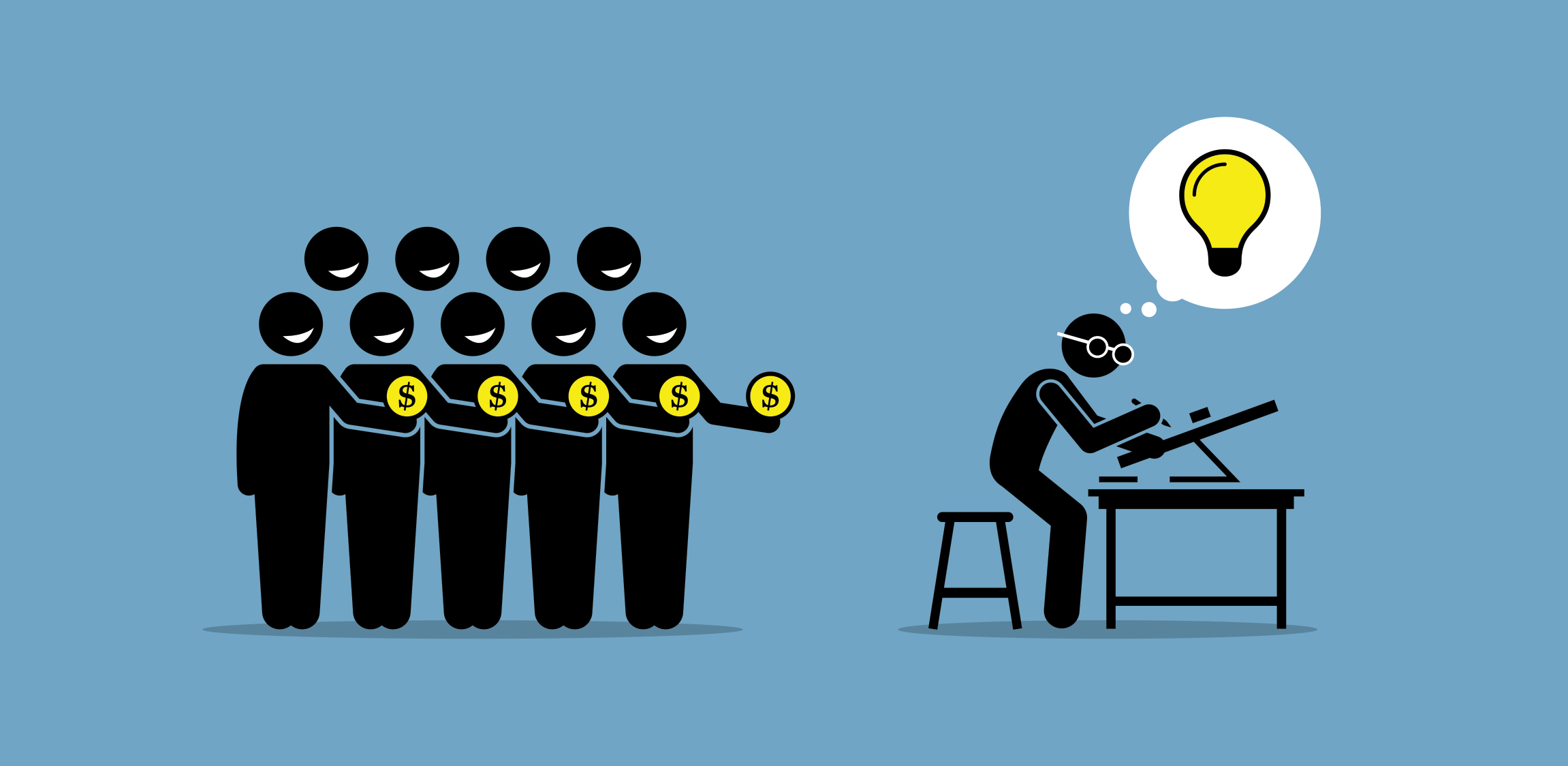

Peer-to-peer (P2P) money borrowing has become a game-changer in the world of personal finance, offering individuals an alternative to traditional lending institutions. These platforms connect borrowers directly with individual lenders, fostering a more dynamic and inclusive approach to borrowing. In this exploration, we uncover the diverse benefits of peer-to-peer money borrowing and how it is reshaping the borrowing landscape.

1. Competitive Interest Rates:

Peer-to-peer money borrowing often comes with competitive interest rates. By eliminating the need for traditional financial intermediaries, borrowers can secure loans at rates that are often more favorable than those offered by traditional banks. This can result in significant savings over the life of the loan.

2. Accessible Funding Opportunities:

P2P lending platforms provide accessible funding opportunities, especially for individuals who may face challenges securing loans from traditional institutions due to limited credit history or unique financial situations. This inclusivity empowers a broader range of borrowers to meet their financial needs.

3. Streamlined Application Process:

The application process for peer-to-peer money borrowing is typically streamlined and user-friendly. Borrowers can create loan listings, specifying their needs and terms. This simplicity accelerates the overall borrowing process, providing quick access to funds when needed.

4. Direct Connectivity:

Peer-to-peer money borrowing establishes direct connectivity between borrowers and lenders. This direct link enhances communication, allowing borrowers to convey their needs and lenders to evaluate potential investments. The result is a transparent and collaborative borrowing experience.

5. Flexible Loan Terms:

P2P lending platforms offer flexible loan terms that borrowers can negotiate directly with lenders. This flexibility allows borrowers to tailor their repayment plans to align with their financial capabilities and ensures a more personalized borrowing experience.

6. Speedy Access to Funds:

The nature of peer-to-peer lending enables borrowers to access funds quickly. Once a loan is successfully funded on the platform, borrowers can receive the funds promptly, making it an ideal solution for situations that require urgent financial support.

7. Diverse Borrowing Options:

P2P money borrowing platforms offer a diverse range of borrowing options, catering to various needs such as personal loans, debt consolidation, or small business financing. This diversity ensures that borrowers can find a loan product that suits their specific financial requirements.

8. Global Accessibility:

Peer-to-peer lending operates in the digital realm, allowing borrowers to access funds globally. The borderless nature of these platforms provides borrowers with opportunities to secure funding from a wide pool of lenders, regardless of geographical location.

9. Community Connection:

P2P money borrowing fosters a sense of community between borrowers and lenders. The direct interaction and mutual support create a collaborative environment where both parties have a stake in each other's financial success.

Conclusion:

Peer-to-peer money borrowing stands as a testament to the evolving landscape of personal finance. The competitive rates, accessibility, streamlined processes, and community-driven nature of P2P lending platforms are transforming how individuals approach borrowing. As these platforms continue to gain prominence, the benefits of peer-to-peer money borrowing are poised to play a pivotal role in shaping the future of borrowing practices worldwide.

Write A Comment